Investors Hot for Cold Play in Space

By ProcureAM Research

There may not be any kiss cams on the International Space Station yet, but cold is playing a potential growth opportunity within the space economy. The cool environment of space has been highlighted as a plus for specialized manufacturing and research applications. Now space is being viewed as an optimal location for data centers.

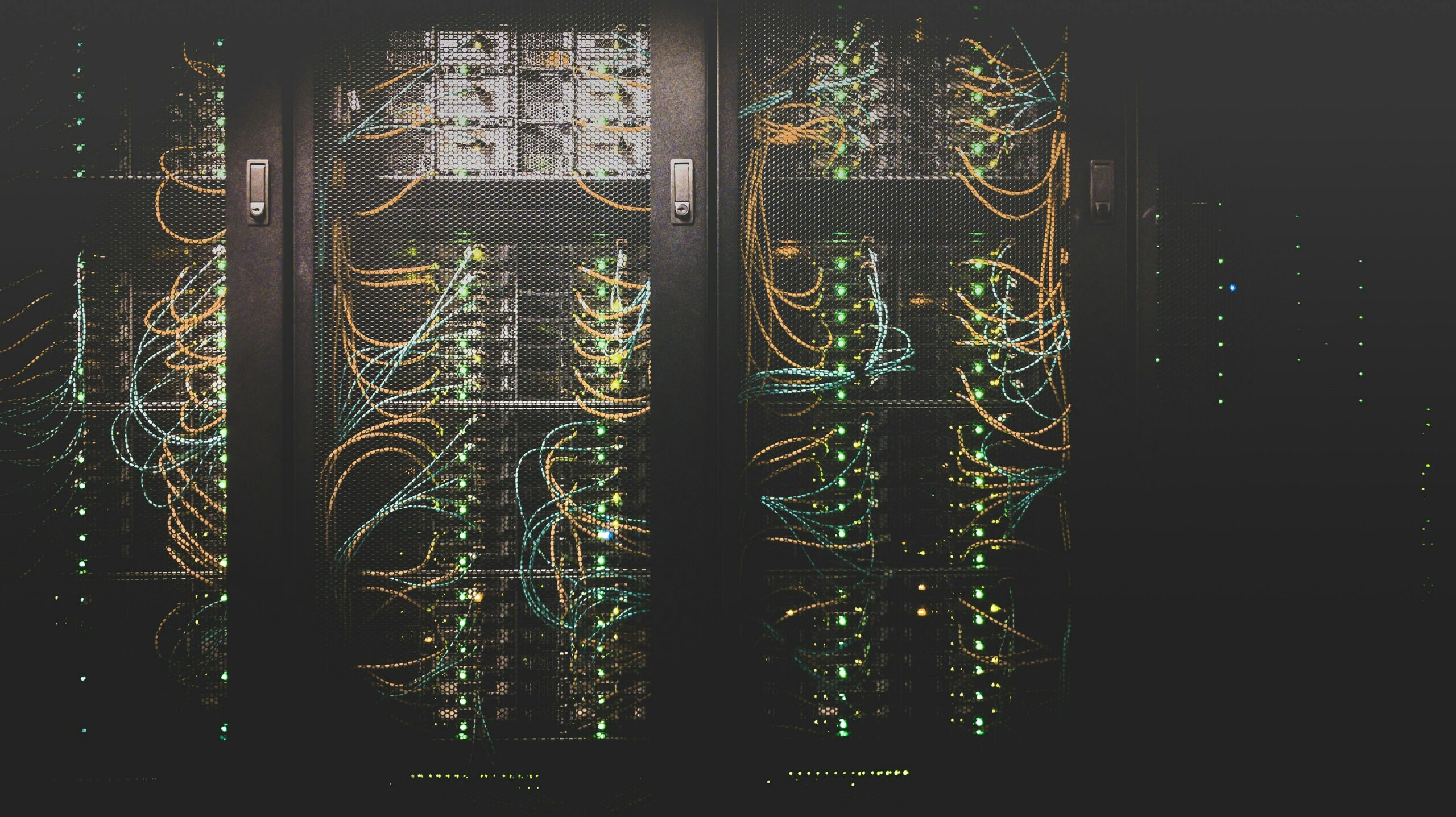

Artificial Intelligence (AI) applications have exploded, along with the need for data centers to accommodate AI usage. Data centers occupy a large footprint, require massive energy volumes, and generate excessive heat. Space and moon options for data centers offer several advantages including:

- The cold and vacuum of space can be conducive to quantum computing by reducing the need for energy intensive cooling systems.

- Unconstrained real estate is currently available both on the moon and in outer space.

- Energy efficiency is another plus with access to solar energy.

Science fiction concepts are now becoming reality via lower launch costs and private and government spending. New names are now emerging as important players within the industry:

- Companies like Rocket Lab* are making launches common occurrences.

- Intuitive Machines* is focused on delivering payloads to the moon; collecting, processing, and interpreting space-based data; and providing infrastructure as a service for lunar systems.

- Redwire* seeks to deliver reliable, economical, and sustainable space infrastructure.

- ispace* has a vision to enable a human presence on the moon by developing water resources.

- Avio* is focused on space propulsion for launching payloads in earth orbit.

The Procure Space ETF® (NASDAQ: UFO) includes 40+ global corporations participating in all aspects of the exciting space economy. The up-and-coming companies listed above are constituents within the UFO, along with well-known players in the industry including Boeing*, RTX*, Lockheed Martin*, Northrop Grumman*, and L3Harris *.

UFO has paid out dividends and/or quarterly income. In 2024, the distribution was $0.45 per share. Please click here for the fund’s dividend information. Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 866-690-ETFS (3837).

Yet again, space may help us improve our lives back here on Earth. For more information on the Procure Space ETF®, please visit www.procureetfs.com.

Important Information:

*As of July 25th, 2025, Avio (AVIO IM) was a 0.93% holding, Boeing (BA) was a 2.26% holding, Intuitive Machines (LUNR) was a 3.70% holding, ispace (9348 JP) was a 0.67%, L3Harris (LHX) was a 2.18% holding, Lockheed Martin (LMT) was a 1.78% holding, Northrop Grumman (NOC) was a 2.22% holding, Redwire (RDW) was a 1.15% holding, Rocket Lab (RKLB) was a 7.28% holding in the Procure Space ETF® (NASDAQ: UFO).

For a complete list of holdings in UFO, visit: https://procureetfs.com/ufo/. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Please consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest. This and other important information is contained in the Fund’s summary prospectus and prospectus, which can be obtained by visiting procureetfs.com. Read carefully before you invest.

Investing involves risk. Principal loss is possible. The Fund is also subject to the following risks: Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Aerospace and defense companies can be significantly affected by government aerospace and defense regulation and spending policies. The exploration of space by private industry and the harvesting of space assets is a business based in future and is witnessing new entrants into the market. Investments in the Fund will be riskier than traditional investments in established industry sectors. The Fund is considered to be concentrated in securities of companies that operate or utilize satellites which are subject to manufacturing delays, launch delays or failures, and operational and environmental risks that could limit their ability to utilize the satellites needed to deliver services to customers. Investing in foreign securities are volatile, harder to price, and less liquid than U.S. securities. Securities of small- and mid-capitalization companies may experience much more price volatility, greater spreads between their bid and ask prices and significantly lower trading volumes than securities issued by large, more established companies. The Fund is not actively managed so it would not take defensive positions in declining markets unless such positions are reflected in the underlying index. Please refer to the summary prospectus for a more detailed explanation of the Funds’ principal risks. It is not possible to invest in an index.